Fire-proofing for a hard insurance market

How can your business assess its vulnerabilities and mitigate against the domino effect?

11th March 2021

No jab, no job?

9th April 2021The consequences of COVID-19 have reinforced the major risks posed to UK businesses when it comes to assessing risk and planning for crises. For most organisations life after the pandemic means a new operating context, on everything from human resources to supply chains to fire safety.

Our own response at Horizonscan involves an exciting new phase as an employee-owned organisation. For us as specialists in business resilience, this shift is more than just an internal change in governance or structure. Employee ownership encourages sustainable business approaches, which help us to live up to our values.

Of course, every company is different. But ultimately almost no one will be returning to ‘business as usual’ once it becomes clear what a post-COVID-19 world looks like (and whenever that world materialises).

So, what does the new context look like in practice? What is going to change, beyond a great deal more hand-sanitiser being used? And what is the thread which connects COVID-19, fire safety and business resilience?

The really big change, which few currently seem to be talking about, relates to insurance. Over the last ten to 15 years we have been experiencing something often referred to as a ‘soft’ insurance market. However, we are currently experiencing the most dramatic ‘hardening’ of the market in many years – since 9/11 and the 2008 financial crash, in fact.

A ‘hard market’ means that demand for insurance against fires and other disruptive events will be greater than supply. There will be fewer insurers in the market, and for many industries it will become more expensive to find appropriate cover. Some organisations will be unable to afford insurance, and – depending on the regulations in their sector – they will either take on more risk or fold.

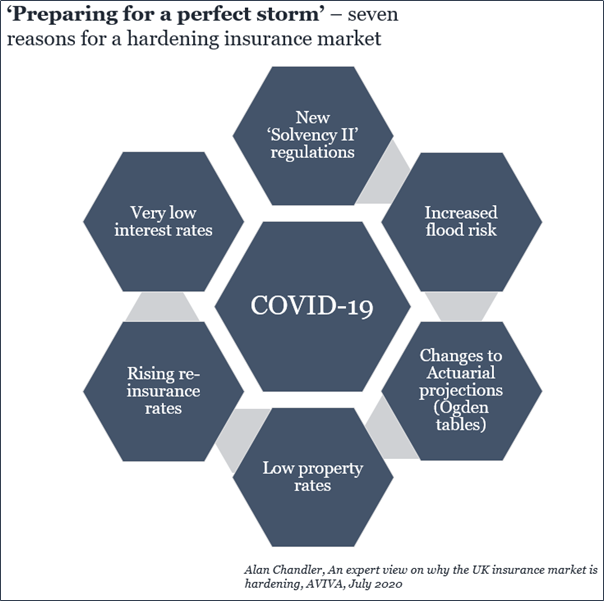

This was highlighted in a 2020 lecture, delivered to AVIVA employees by expert Alan Chandler. He described a coalescence of ‘hardening’ factors – seven in total – which amounted to a ‘perfect storm’. (See his slides here. His seven factors are displayed in the diagram below).

These include technical changes for the insurance sector, such as new regulations on solvency, new actuarial forecasts and low interest rates. They also include a dramatic uptick in weather risks, underscored by the heavy flooding in England at the start of this year.

Meanwhile COVID-19’s role in ending this ‘soft’ market is, of course, huge. It is less the straw that broke the camel’s back than the anvil. The pandemic is a sea-change moment, which could do for insurers what the 2008 crash did to the finance sector.

In other words, while the virus has not single-handedly created the ‘hardening market’ described above, it has dramatically accelerated it.

What this means in practice is that companies will have to improve their safety practices and protocols to avoid sharp rises in premiums and retentions.

Federation of Small Business data shows that 99 per cent of all UK companies are SMEs employing less than 250 people. Fire prevention and flood safety, along with measures to address other major risks, could become a driving corporate priority for these organisations.

Doing the bare minimum may once have meant paying a little extra for cover. But in the new ‘hard market’ – where tighter supply means insurers will be more selective to whom they give their limited coverage capacity – it could put you out of business. At a minimum, more proactive efforts to build resilience will be needed, to differentiate each business from the pack, and to achieve lower pricing and broader cover.

Many of the clients we currently work with are already taking the necessary steps. They know a ‘perfect storm’ is in the offing when it comes to insurance. They want to avoid a worst-case scenario, whereby they cannot source cover due to prohibitively high premiums or retentions, or else are not seen as a safe bet to sell to.

Hence, they are re-investing in business continuity plans and in the preparedness of their workforces. And they are stress-testing their resilience assumptions in the face of fire, cyber-attack or extreme weather.

Zurich’s five key risk management recommendations:

- Focus on prevention rather than recovery, reducing exposure while developing strong response and building continuity plans

- Understand high-value supply chain vulnerabilities and interconnected risks

- Emphasise employee preparedness at work and home so they remain safe and are in a position to help keep the business running from a remote location

- Review insurance coverage, as proper multi-hazard coverage will speed recovery and allow businesses to be up and running faster, which means “retaining a customer base rather than re-attracting one”

- Conduct a post-event review if disaster strikes to better prepare the organisation

‘Every dollar spent on resilience saves five: Zurich’, June 2020

By investing early in practical measures, they hope to be ahead of the curve, giving insurers the confidence to continue investing in them as the market hardens. Indeed, the insurance giant Zurich wrote in a risk insights report that there is ‘a very clear case for investing up front rather than spending money only after an event to deal with incurred losses and finance repair’. (In the box above are Zurich’s five key risk management recommendations).

Investing in loss prevention and minimisation now can not only minimise the likely premium increases and narrowing of cover that most businesses are headed towards. It could actually pay real dividends by helping avoid or reduce actual losses. And it may even save lives.

Fire safety remains the primary concern for many businesses – especially for SMEs with only a single or handful of major sites. For us at Horizonscan, meanwhile, fire-related resilience was the route by which we started to look at business risk in the first place. Many of our consultants joined us from senior positions in the Fire Service and continue to provide expert advice to the industry.

The shifts described above mean that, as it gets harder to cover the risks faced, it will become all the more important to reduce both their likelihood and impact. For organisations seeking insurance and for fire safety professionals alike, this could mean a fundamental shift.

Will Scobie is Director of Finance and Business Development